Assessing the benefits of supply chain trust:

NK simulation-based methodology and application

Ilaria Giannoccaro

Polytechnic University of Bari, ITA

Antonio Capaldo

Catholic University of the Sacred Heart, ITA

ABSTRACT

Previous literature has emphasized that developing trust among supply chain (SC) firms is a critical element in achieving SC effectiveness. Since developing trust is an expensive task, however, making an informed decision whether to invest or not in trust requires careful assessment of trust benefits. Therefore, we advance a simulation-based methodology to quantify performance improvements associated with trust in SCs. We develop an NK simulation model of a generic SC that captures the SC dynamics under two alternative scenarios, characterized by the presence and absence of trust respectively. A procedure is then illustrated to quantify the benefits of trust in the SC. We also apply our proposed methodology to a real-world SC. Results show that, when trust is pervasive across the SC, performance increases at both the levels of the overall SC and its leading firm.

Introduction

A critical element in achieving supply chain (SC) effectiveness resides in developing trust among SC firms. A significant literature has in fact pointed out the positive effects of trust on the efficient and effective management of SCs and showed that trust is a powerful antecedent of effective cooperation and a significant predictor of positive performance outcomes (Kumar, 1996; Monczka et al., 1998; Johnston et al., 2004; Narasimhan & Nair, 2005; Ireland & Webb, 2007).

Despite the great deal of research that has stressed the importance of trust in SC contexts, quantitative assessments of the benefits of trust are still lacking to date. More generally, whereas the benefits of trust in interorganizational relationships have been largely investigated and discussed, the extent of the positive effect that trust exerts on performance is an issue neglected in previous studies (but see Krishnan et al., (Krishnan et al., 2006) for a notable exception). However, since developing trust is an expensive task, which entails substantial costs for firms, (Wicks et al., 1999) making an informed decision whether to invest or not in trust requires careful assessment of trust benefits. Therefore, we develop a simulation-based methodology to quantify performance improvements associated with trust in SCs.

Extant research on trust in SCs has typically focused on dyadic relationships (Dyer & Chu, 2003; Johnston et al., 2004; Capaldo, 2014). Conversely, trust at the level of the overall network within which the dyads are embedded (i.e., the SC) has not been much investigated. However, Ireland and Webb (Ireland & Webb, 2007) have pointed out that, in order to reach a better understanding of how trust affects performance in SCs, supply chain scholars should concentrate on network-level trust. Moving along this research trajectory, recent literature has focused on "supply chain trust"—that is, network-level trust in SCs (Capaldo & Giannoccaro, 2015; Capaldo & Giannoccaro, 2015)—and defined it as the extent to which trust is pervasive across the SC. Building on this literature, we aim at quantifying the benefits associated with SC trust, rather than with trust in dyadic buyer-supplier relationships.

We adopt a simulation-based methodology drawn from complexity science. Previous scholars have pointed out that SCs are complex adaptive systems (CASs), namely sets of interacting agents which self-organize and co-evolve with the environment, and suggested to employ CAS theory and tools to study SCs (Capaldo & Giannoccaro, 2015; Giannoccaro, 2015; Choi et al., 2001; Surana et al., 2005; Pathak et al., 2007; Olson et al., 2014). In particular, we draw on previous research that has employed Kauffman's (1993) NK framework to analyze management problems (see Ganco & Hoetker, 2009 for a review).

We develop an NK simulation model of a generic SC that captures the SC dynamics under two alternative scenarios, characterized by the presence and absence of trust (and therefore labelled 'trust scenario' and 'no-trust scenario') respectively, and takes into account the specific form of governance that characterizes the SC. A procedure is then illustrated to quantify the benefits of trust in SCs, which consists of running the simulation model in the trust and no-trust scenarios, collecting the associated SC performances, and calculating the difference between them, which measures the extent to which trust is beneficial to the SC. In the final part of the paper we apply our proposed methodology to a real-world SC. Results show that, when trust is pervasive across the SC, performance increases at both the levels of the overall SC and its leading firm.

The paper is organized as follows. Initially, we briefly review the relevant literature on SCs as CASs and on trust in SC contexts. Next we describe a methodology, based on NK simulation, for quantifying the benefits of trust in SCs. We then present and discuss the results of the application of our proposed methodology to the leather sofa Natuzzi supply chain. The last section provides conclusions and outlines the limitations of our study.

Theoretical background

Supply chains as complex adaptive systems

SCs consist of multiple interconnected firms involved in several different processes and activities that generate value in the form of products and services that are delivered to the ultimate consumers. SCs include raw material suppliers, suppliers of components and work in process products, assemblers, and distributors of the final products (Christopher, 1992). Complexity characterizes SCs in many aspects. Indeed, complexity in SC contexts is due to the number of firms to be integrated both horizontally and vertically along the value chain; it concerns the variety of firms in terms of organizational culture, size, location, and technology; it depends on the levels and motives of interconnection among them; it arises by the need to share critical information and strategically relevant knowledge among the participating firms; it increases with the multiple sources of uncertainty that plague performances; and it is shown in the unpredictable and non-linear effects of local (i.e., firm-level) decisions on global (i.e., supply chain-level) behaviors (Choi & Hong, 2002; Choi & Krause, 2006; Lee et al., 1997; Simchi-Levi et al., 2000).

A largely used approach to deal with complexity is complexity science, and in particular, the theory of complex adaptive systems (CASs) (Dooley, 1997; Holland, 1995; Holland, 2002). CASs are networks of adaptive agents that emerge over time into coherent forms through interaction, without any singular entity or central control mechanism deliberately managing or controlling the overall system (Holland, 1995). Adaptation and self-organization are major features of CASs. Adaptation means that the system changes, so improving its fitness with the environment, and creates new forms of emergent order consisting of new structures, patterns, and properties. Adaptation is possible thanks to self-organization, i.e., the new order arises from interaction among the agents, rather than being externally imposed on the system (Goldstein, 1999).

Scholars have framed SCs as CASs and employed CAS theory both to describe several dimensions of SC complexity and to explain their behavior (Choi et al., 2001; Surana et al., 2005; Pathak et al., 2007; Giannoccaro 2015). For example, Choi and Hong (Choi & Hong, 2002) have gauged SC complexity by means of horizontal, vertical, and spatial complexity measures that are, respectively, the average number of entities across all SC tiers, the average number of entities in all possible vertical SCs, and the average geographical distance between companies in the top two tiers of the SC. Choi and Krause (Choi & Krause, 2006) have used CAS theory to identify the key aspects of the supply-base complexity: the number of suppliers, their variety, and the inter-relationships among them. Choi and Krause (Choi & Krause, 2006) have also related the level of complexity with transaction costs, supply risk, supplier responsiveness, and supplier innovation. More recently, Bozarth et al. (2009) have defined SC complexity as the level of detail complexity and dynamic complexity exhibited by the products, processes, and relationships that make up the SC. Finally, Choi et al. (2001) and Pathak et al. (2007) have recognized that SCs exhibit the main properties of CASs, i.e., self-organization, adaptation, and co-evolution.

Supply chain dynamics under different forms of governance

Framing SCs as CASs requires explaining SC dynamics in terms of self-organization and adaptation. Accordingly, the SC is thought of as an emergent, self-organized system that is made up of interacting agents (firms) and, without any central control, modifies its state (in terms of, among others, products, production processes, and adopted technologies) continuously, in order to improve its fitness to the environment and, by doing so, gain higher performance. This self-organized and adaptive process is influenced by the specific form of governance of the SC, which stipulates how coordination among the interacting SC firms is accomplished (Rivkin & Siggelkow, 2003; Giannoccaro, 2011).

As pointed out in previous studies, the SC can be characterized by alternative forms of governance, ranging from pure market to hierarchy (Stock et al., 2000), which can be conceptualized in terms of the following organizational variables: degree of vertical integration; degree of collaboration; degree of centralization of the decision making process; and distribution of the bargaining power (Giannoccaro, 2011). The degree of vertical integration is the extent to which a single firm owns the entire SC (Stock et al., 2000). When the degree of vertical integration is high, the SC resembles a hierarchy and consists of just one firm performing all the activities and driving the evolution of the SC in a desired direction. Conversely, when the degree of vertical integration is low, the SC is composed of a number of firms, each performing a given set of SC activities.

The degree of collaboration is the extent to which firms are committed to the SC relationships, share information, and cooperate with each other, so pursuing common goals (Mentzer et al., 2001; Lamming, 1996). When the degree of interfirm collaboration is high, thanks to intensive information sharing and little risk of opportunistic behaviors, the SC evolves in ways that allow the attainment of common goals. Conversely, when the degree of interfirm collaboration is low, each firm in the SC pursues its own interest and the SC evolves accordingly.

The degree of centralization is extent to which the decision making process is governed by a single SC firm. The SC adopts a centralized approach when only one SC partner makes decisions for all the SC members so as to optimize the overall SC performance. Alternatively, the SC can be arranged in a decentralized fashion, characterized by the existence of multiple decision makers which make decisions so as to optimize their local performances.

The distribution of bargaining power refers to whether there is a leading firm in the SC having the power to drive the SC in the desired direction (Cooper & Ellram, 1993; Giannoccaro, 2011). When bargaining power is asymmetrically distributed across the SC, the leading firm influences the SC evolution, which tends to conform to the leading firm's interest, rather than to the interest of the overall SC. Conversely, when bargaining power is symmetrically distributed across the SC, no firm has the power to influence the evolution of the SC in the direction most in line with its own interest.

Trust in supply chains

Dozens of definitions of trust have been offered by previous scholars (Mayer et al., 1995; Rousseau et al., 1998; Dirks & Ferrin, 2001). Extant literature conceptualizes trust in terms of fairness, loyalty, vulnerability, dependability, opportunism, and benevolence (Seppanen et al., 2007). In the present study, trust is framed as a governance mechanism, rooted in both social networks and economic calculus, which leads firms participating in SCs to adopt collaborative behaviors, that is, to act in the best interest of the SC rather than in their own best interest (Bradach & Eccles, 1989; Heide & Miner, 1992).

Previous studies on trust in SC contexts have typically conceptualized trust as a dyadic construct. Thus, attention has been drawn to trust within the dyadic relationships of which SCs are composed of (Larson, 1992; Capaldo, 2007), while little attention has been paid to the whole network wherein dyadic SC relationships are embedded (Ireland & Webb, 2007). To fill this gap, we focus on trust as a network-level construct (i.e., SC trust) and define SC trust as the extent to which trust is pervasive across the SC.

We argue that trust is pervasive across a SC when SC partners behave in the interest of the overall SC, and therefore they will not make decisions detrimental to the SC. Thus, when trust is widespread across the SC, SC partners behave collaboratively (i.e., in the best interest of the SC), so as to increase the SC overall performance, regardless of the impact of such behavior on their individual performance. Conversely, in the absence of trust, partners do not behave collaboratively if doing so may lead to a local disadvantage; therefore, SC partners behave in the interest of the SC only when doing so is not detrimental to their local performance.

Extant research suggests that trust is a key predictor of enhanced performance in SCs in terms of improved flexibility, responsiveness, and cost reduction (Handfield & Bechtel, 2002; Narasimhan & Nair, 2005; Ireland & Webb, 2007; Laaksonen et al., 2009). Indeed, trust encourages partners to collaborate more intensively (Gambetta, 1988), to participate in information sharing and knowledge transfer activities across their organizational boundaries, and to engage in risk-taking initiatives (Mayer et al., 1995), thereby increasing the opportunities for firms participating in trust-based SC relationships to create value at both micro and macro levels (Uzzi, 1997). Moreover, trust has been recognized as a determinant of successful collaboration among firms and associated with enhanced predictability of partners' behavior, lower transaction costs, and improved adaptability and strategic flexibility, with beneficial effects on performance (Zucker, 1986; McEvily et al., 2003; Krishnan et al., 2006; Capaldo, 2014).

Whereas the benefits of trust have been deeply investigated, the extent of such beneficial effects is an issue largely neglected in previous studies. However, in order to make informed decisions about whether or not to invest in the development of trust, SC firms and their managers need to understand how much trust impacts SC performance.

An NK simulation-based methodology for quantifying the benefits of supply chain trust

The NK fitness landscape

The NK fitness landscape is a simulation technique originally advanced by Kauffman (Kauffman, 1993) in the context of evolutionary biology and extended to investigate organizational decision problems in subsequent studies (McKelvey, 1999; Gavetti & Levinthal, 2000; Rivkin & Siggelkow, 2003; Rivkin & Siggelkow, 2007; Ganco & Hoetker, 2009; Giannoccaro, 2011). In these studies, the system (e.g., a firm, product, technology, strategy, plant, or SC) is conceptualized as a set of N elements and K interactions among them. Each element may take different states. Typically, it is assumed that each element takes a binary state, i.e., it may equals 0 or 1.

When the NK fitness landscape is used for modeling purposes at the firm level, the firm is conceptualized as a set of N interdependent activities or, that is the same, decisions concerning how to accomplish those activities (hereinafter we will use the expressions 'activities' and 'decisions' interchangeably). Decisions may concern, for example, what new products to launch or IT solution to adopt, as well as procurement policies, production and transportation schedules, and inventory management policies.

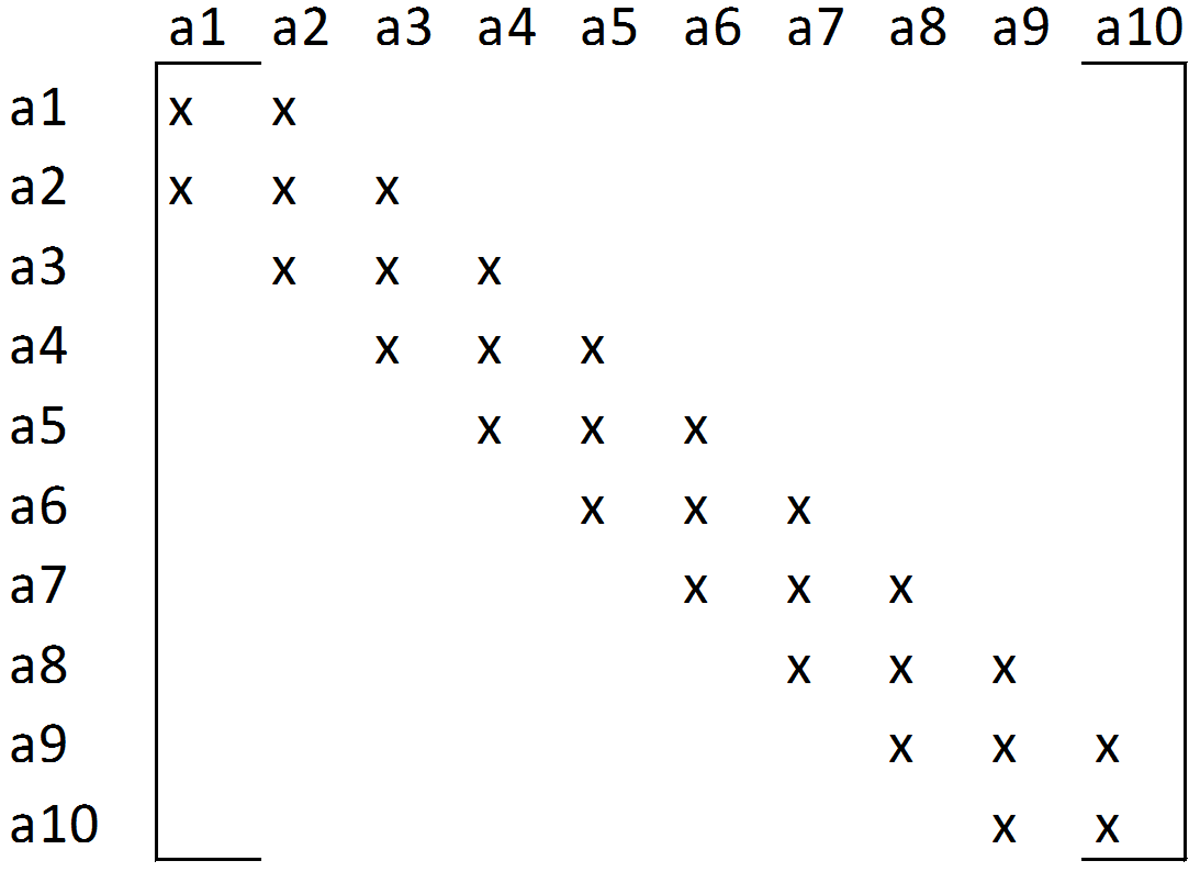

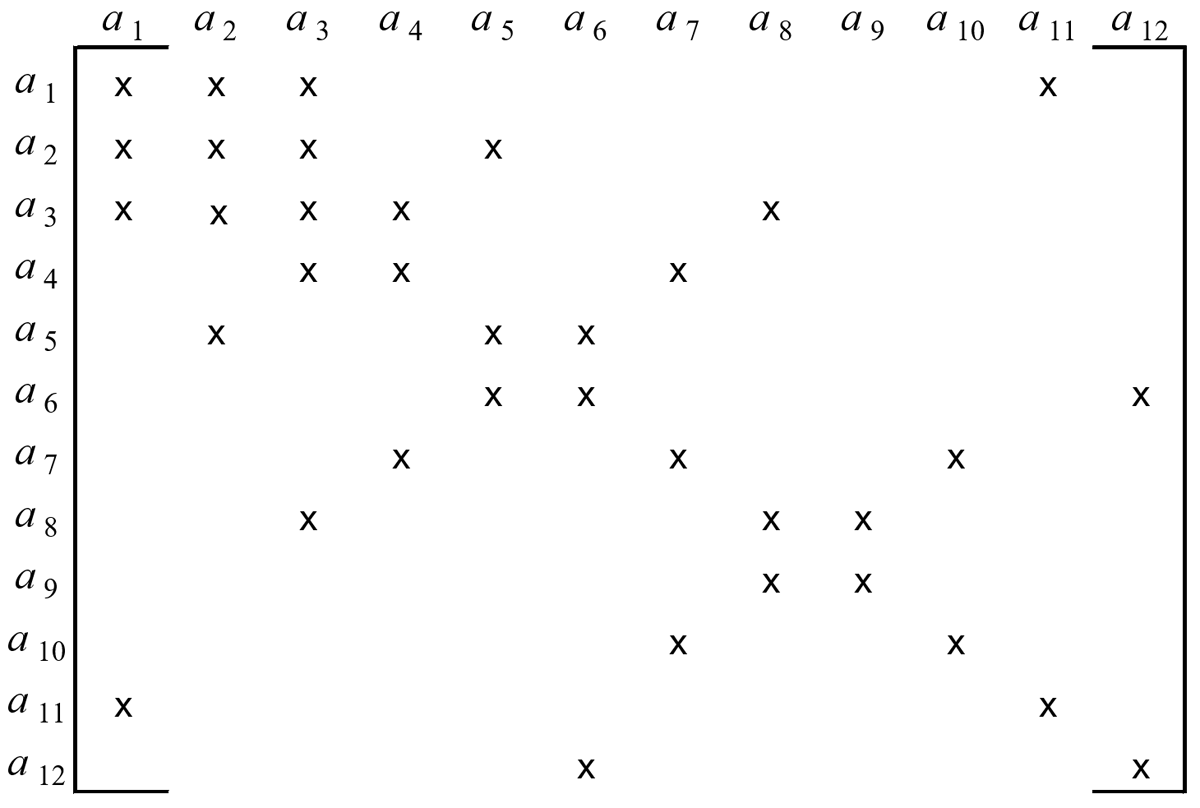

A particular N-digit string d=(d1, d2, ..., dN) represents a specific combination of choices regarding the decisions to be made (i.e., a choice configuration). K is the average number of interactions among the decisions di, and therefore expresses the degree to which the decisions interact with each other. When decisions interact with each other, the contribution of a decision to the system payoff depends on the choice made on the decisions interacting with it. For example, the adoption of a new IT infrastructure can be more or less effective depending on whether the firm decides to invest in workforce training. Analogously, the decision to reduce the safety stock could be detrimental to the firm if the firm also decides to adopt a multiple sourcing policy and to base its supply strategy on arm's length relationships with suppliers, while it could be beneficial to the firm should it adopt a single sourcing policy and a supply strategy based on partnership relationships with suppliers. The overall pattern of interactions among the decisions, mapping which decision interacts with which other decision, is contained in an NxN influence matrix where each x in the (i,j) position means that the column decision j influences the row decision i.

The different ways in which the firm's choices (0-1) about the decisions are combined generate 2N possible choice configurations, each of which is associated a fitness value for the overall system, i.e., a firm overall payoff P(d). The map showing, for each possible choice configuration, the values of the corresponding payoffs, represents the fitness landscape. In such a landscape, each possible choice configuration is translated into a point representing a specific position that the system may occupy, while the height corresponding to each point expresses the payoff associated to each configuration. The landscape is thus made up of valleys and peaks. The highest peak of the landscape (i.e., the global peak) corresponds to the configuration yielding the highest payoff and expresses the global optimum. Local peaks correspond to suboptimal, yet still favorable (i.e., second-best) configurations and express the local optima.

To generate the fitness landscape, a stochastic procedure is adopted (Kauffman, 1993). For each choice configuration, each single decision di offers a contribution Ci to the overall payoff, which in turn is calculated by averaging the N contributions. Therefore, . The contributions Ci are drawn randomly from a uniform distribution over [0,1]. Note that each Ci depends not only on the corresponding decision but also on how the decisions interacting with it are resolved. Once the landscape has been designed, it is assumed that the firm is engaged in an adaptive walk across the landscape in search of the global peak. The goal of this search is to identify the choice configuration that yields the highest firm overall payoff, or in other words, to reach the global peak.

Thus, the NK fitness landscape is an optimization decision problem whose solution is achieved by simulating the firm's adaptive walk across the landscape. This adaptive walk is modeled through a search algorithm. The most commonly adopted algorithm is based on an incremental improvement strategy which includes the following steps: 1) proposition of new alternative configurations obtained by changing the choice on a limited number of decisions; 2) comparison of all or some of the new configurations with the existent configuration (i.e., the status quo); and 3) movement of the system to occupy a new configuration, provided that the latter is better than the status quo. Performance in the NK fitness landscape is measured in terms of efficacy and speed in finding the global peak. Efficacy is commonly measured by the overall system payoff at the end of the search period, computed as a proportion of the maximum performance attainable on the landscape (Ganco & Hoetker, 2009).

NK model of the supply chain

Whereas previous research has typically employed the NK framework at the firm level, recent studies have applied the framework to multi-firm contexts. In particular, Aggarwal et al. (2011) have proposed a NK model of a dyadic strategic alliance, while Giannoccaro (2011) and Capaldo and Giannoccaro (2015) have extended the NK model to the SC. In the model proposed by Giannoccaro (2011), the SC is made up of two firms (a buyer and a supplier) making decisions on N operational activities (d1, d2, ..dN). Each single activity can assume only two values (0 or 1), each corresponding to a different way of performing it. Interactions occur among activities because SC firms are interconnected with each other. K is the number of interactions among operational activities and expresses SC complexity: the higher K, the higher the degree of SC complexity.

In the present paper, we generalize this model to a SC including more than two firms. The SC is composed of L firms, grouped in S supply chain stages (e.g., supply of raw materials, supply of semi-finished products, and assembly). Each firm performs a given number of value chain activities. The map of the production process summarizes the overall set of activities (N) performed by the SC firms and the relationships between them. In particular, the interactions occurring among the activities are reported by the SC influence matrix, mapping which activity interacts with which other activity. The existence of an interaction link between the activities ai and aj of the production process is expressed by an x in the (i,j) and (j,i) cells of the influence matrix.

Consider the case of a four-stage coffee SC whose production process consists of the following sequential activities: a1) cultivating the coffee plant; a2) picking the coffee cherries; a3) separating the bean from the shell; a4) greenish tinging to obtain green beans; a5) blending; a6) roasting; a7) grounding; a8) brewing; a9) drying; and a10) packing. The NK model of this SC will be characterized by N=10 activities. Figure 1 shows the overall pattern of interactions among the activities, i.e., the influence matrix (K=2). To complete the NK model of the SC, activities need to be assigned to the stages and to the firms operating in each stage. For example, the activities above could be arranged in four stages and performed by eight firms. Thus, the raw material supply stage could consist of three firms performing activities a1-a2; the semi-finished products supply stage could include two firms, one performing a3 and the other a4; the production stage could contain two firms, each of which carrying out a5-a9; and finally, the assembly stage could include a10 only, performed by only one firm. At this point, the NK performance landscape of the SC can be generated by following the stochastic procedure referred to above. Finally, the procedure adopted by the system to search for the global peak needs to be specified.

Figure 1: Influence matrix for the coffee supply chain

The searching procedure

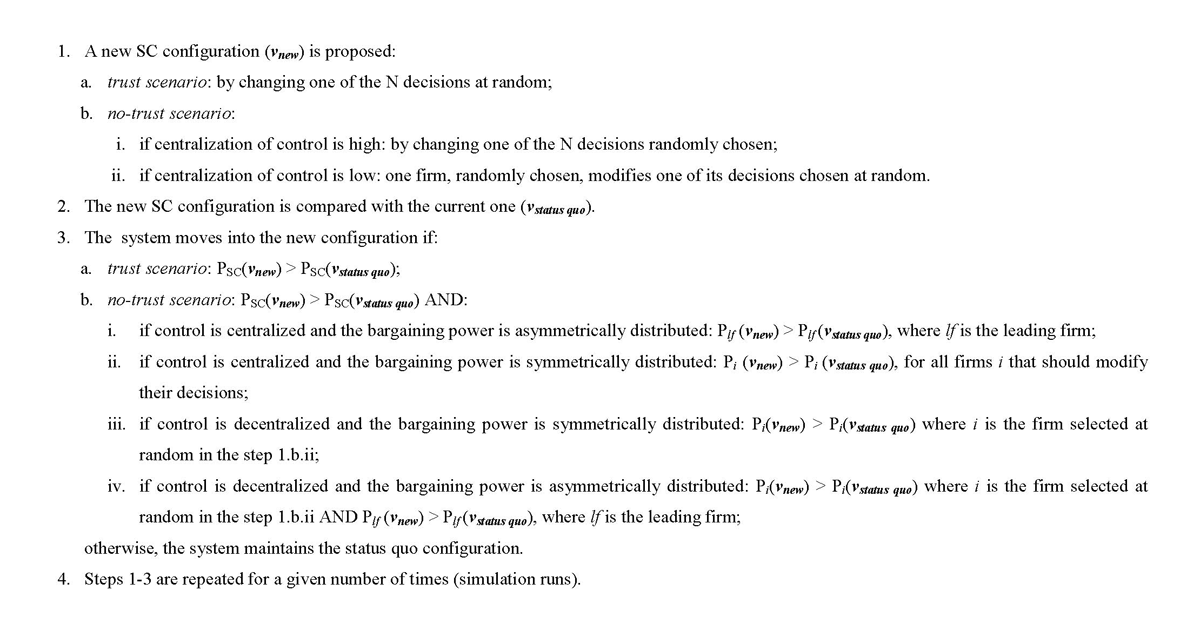

In line with CAS theory, the SC can be thought of as an evolving entity in search of new configurations yielding higher payoffs. In this perspective, the SC aims at reaching the configuration corresponding to the highest SC payoff (global peak). This searching process models the evolution of the SC and is affected by both the specific form of governance and the level of trust that characterize the SC. It includes two basic steps: 1) modification of the current configuration of the SC into a new one; 2) movement of the SC to occupy the new configuration, provided that the new configuration improves a given payoff function. In the following sections the searching procedure adopted by the SC is described by taking into account the specific form of governance of the SC and by distinguishing two alternative scenarios, characterized by the presence and absence of trust respectively.

Modeling of the supply chain dynamics in the presence of trust

As argued above, when trust is pervasive across the SC (trust scenario), all SC firms are expected to behave in the best interest of the SC. More specifically, it is expected that all the decisions made by the SC firms aim at increasing the overall SC performance, even though this entails a disadvantage at the local (i.e., firm) level. Indeed, being trust widespread across the SC, each SC firm is available to behave collaboratively, hence to make decisions that improve SC performance (i.e., the overall SC payoff), regardless of the impact that this behavior exerts on its individual performance (i.e., the local firm payoff). This occurs whatever the SC specific form of governance is, because, in fact, trust operates as a governance mechanism that induces firms participating in the SC to behave in a way that resembles the existence of the following conditions: highly centralized control, high vertical and horizontal collaboration among firms, and symmetrically distributed bargaining power.

This behavior is modeled as follows. A single agent controls all the SC decisions and proposes a new configuration obtained by changing one of the N decisions chosen at random. For example, if the current configuration is vsc status quo = (0,0,0,1,1,1), the new one could be vsc new = (1,0,0,1,1,1). After the searching agent proposes the new configuration, the SC decides whether to adopt it or not. Given the existence of trust, which implies high degrees of collaboration across the SC and symmetrical distribution of the bargaining power, all SC firms are available to adopt the new configuration provided that it improves the overall SC payoff; otherwise, the system maintains its original configuration.

Modeling of the supply chain dynamics in the absence of trust

Should trust be absent across the SC (no-trust scenario), partners are not eager to pursue the overall SC interest if doing so is locally detrimental. Therefore, they will act in the interest of the overall SC only if this does not lead to a local disadvantage. In such a case, the SC behavior can be defined thoroughly only after the specific form of governance characterizing the SC has been specified. Indeed, when trust is absent across the SC, it is reasonable to assume that the SC is characterized by a low degree of collaboration among the participating firms, while the degree of centralization of control and the distribution of the bargaining power may vary. The last two variables influence both the way in which the new configuration is proposed and how the SC makes the decision to adopt it or not. Specifically, four different cases may occur.

If the SC is characterized by high centralization of control coupled with asymmetrical distribution of the bargaining power, a leading firm exists which manages the SC in a centralized fashion and drives the SC evolution according to its own interest. Thus, the leading firm acts as single searching agent who proposes the new SC configuration, which is obtained by modifying one of the N decisions, randomly chosen. The new configuration is adopted by the SC only if two conditions are verified at the same time. The first condition is the same already considered for the trust scenario, and requires that the overall SC payoff associated to the new configuration be higher than that associated to the status quo. The second condition stipulates that the leading firm payoff associated with the new configuration be higher than that associated to the status quo. This last condition reflects the existence of a leading firm driving the SC towards its desired goals.

If the SC is characterized by high centralization of control and symmetrical distribution of the bargaining power, a single firm controls all the activities but no one has the power to influence the SC evolution in a direction coherent with its own goals. In this case, the new SC configuration is again proposed by a central agent who modifies a single, randomly chosen, decision. The new configuration is then adopted by the SC firms only if two conditions are verified. The first condition is identical to the first condition outlined above for the high centralization of control-asymmetrical distribution of bargaining power case. The second condition stipulates that the firms, which according to the new configuration should modify their decisions (or in other words, those containing in their vector of activities the decision to be changed in the new configuration), are available to do so. Note that, in the absence of trust, this occurs only if the local payoffs of these firms in the new configuration are higher than those corresponding to the current one.

If the SC is characterized by low centralization of control and the bargaining power is symmetrically distributed across the SC, each firm controls its own activities and no firm has the power to drive the overall SC evolution. Due to the low degree of centralization of control, the new SC configuration is proposed in a way that differs from the cases in which control is highly centralized, that is: one randomly chosen firm proposes a new configuration by changing at random one of its own decisions. Then, the SC moves into the new configuration if: a) the overall SC payoff of the new configuration is higher than that corresponding to the current one, and b) the local payoff of the firm that proposes the new configuration is higher than that associated to the current configuration.

In case of low centralization of control coupled with asymmetric distribution of the bargaining power, a third condition is added to a) and b) above, that is, the adoption of the new SC configuration also requires that the payoff of the leading firm in the new configuration is higher than that associated to the current one.

Regardless of the specific scenario and case, the firm payoffs are for each SC firm are computed by averaging the contributions Ci of the activities performed by the firm, while the overall SC payoff is computed by averaging the contributions of all the N activities.

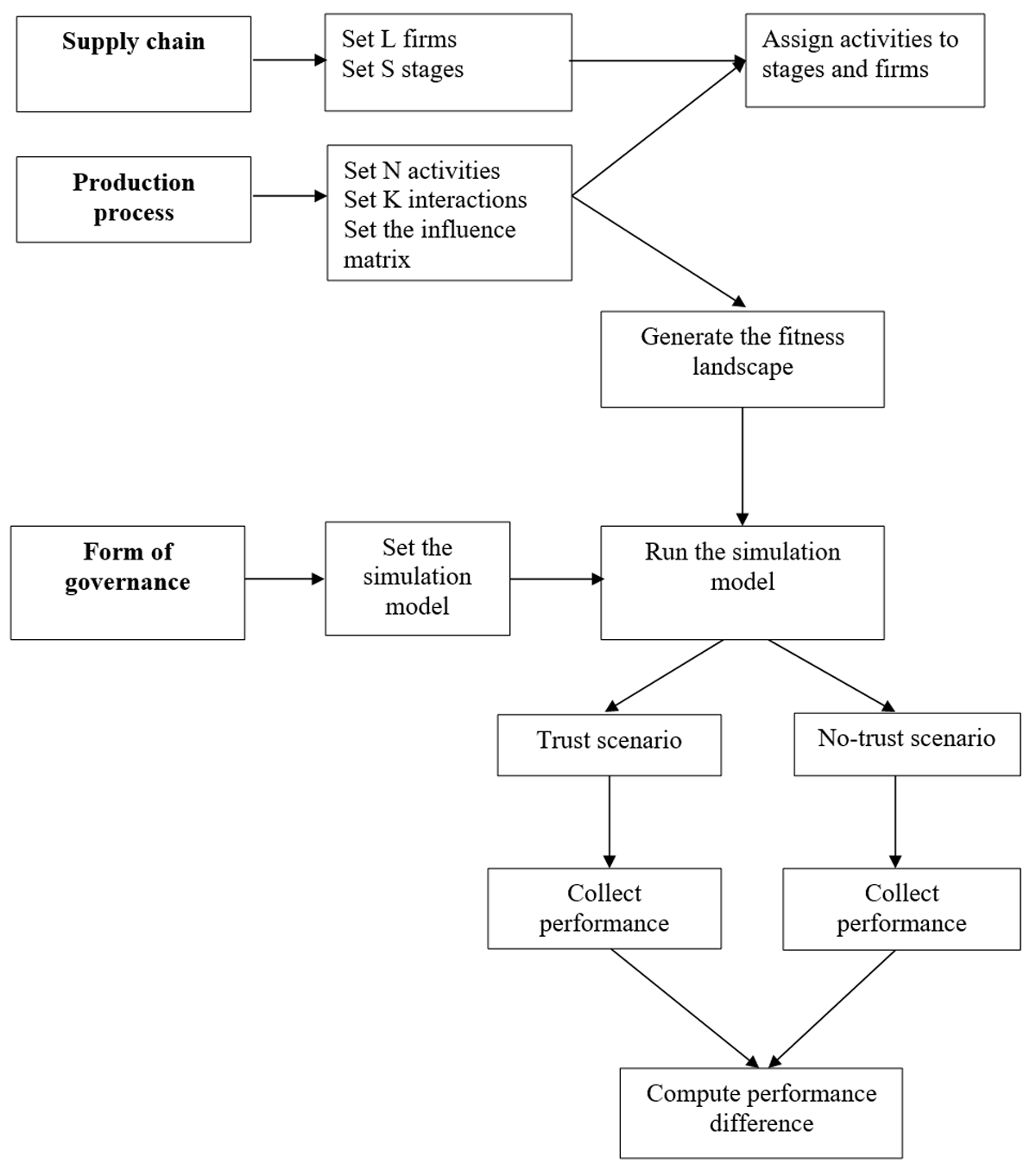

To summarize, the evolution of the SC proceeds through the steps reported in Figure 2.

Figure 2: Searching procedure of the supply chain

At the end of the searching process, the performance of the SC is computed. SC performance is given by the SC payoff at the end of the searching period expressed as a percentage of the maximum payoff attainable on the landscape.

Measuring the benefits associated with supply chain trust

The benefits of SC trust are computed by performing, for the examined SC, two simulations, one for the trust scenario and the other for the no-trust scenario. The difference between the SC performance associated with the two scenarios quantifies the benefits of SC trust.

Figure 3 summarizes our proposed methodology.

Figure 3: Application steps of the proposed NK simulation-based methodology

Application

The Natuzzi leather sofa supply chain

We now report on the application of our proposed methodology to a real SC. In order to define N, K, and the influence matrix for the examined SC, we employed data from previous published studies in which the SCs of three leading firms operating in the same industrial district have been mapped (Carbonara et al., 2002; Albino et al., 2009). In the present paper, we focus on the SC of a single leading firm, namely Natuzzi. Natuzzi is an Italian final firm specialized in sofa production. The company offers a variety of final products, including leather sofas, textile sofas, chairs, and general furniture, each of which corresponding to a specific SC. We focused on the leather sofa Natuzzi SC, in an attempt to quantify the benefits associated with the development of trust across it.

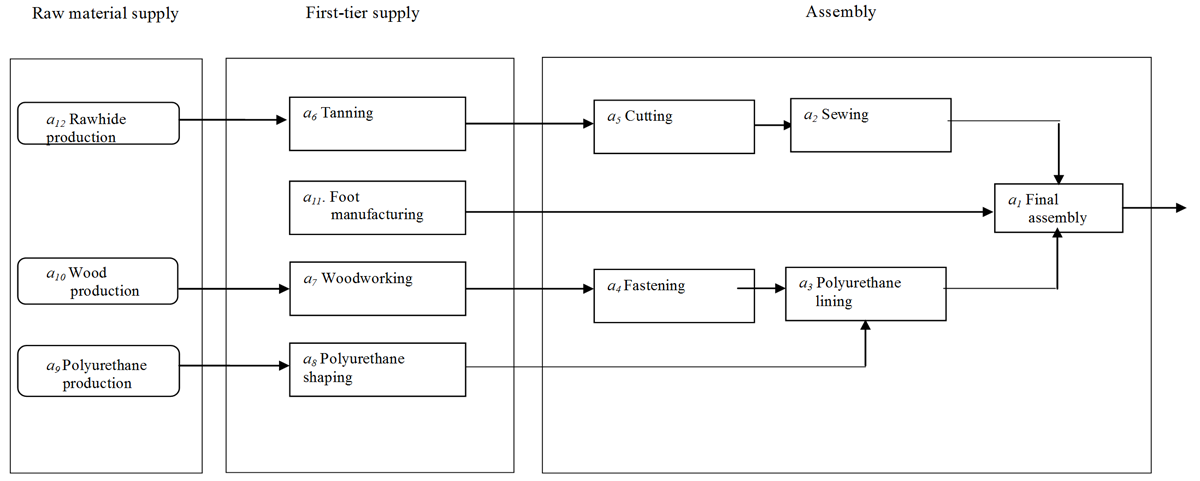

The selected SC is composed of 32 firms grouped in three main stages: 1) raw material supply; 2) first-tier supply; and 3) assembly. Natuzzi operates in the assembly stage and carries out the following activities: cutting, sewing, fastening, polyurethane lining, and final assembly. First-tier suppliers transform the raw materials into components or semi-finished products. Four types of first-tier suppliers can be distinguished, on the basis of the production activity they are specialized in, i.e., tanning (4), polyurethane shaping (8), woodworking (5), and foot manufacturing (10). Finally, raw material suppliers are grouped into three classes, i.e., polyurethane suppliers (1), wood suppliers (2), and rawhide suppliers (1). The map reported in Figure 3 shows the activities by which the leather sofa production process is composed of and the interactions between them.

Simulation setup and results

Based on the map reported in Figure 4, we built the NK model of the Natuzzi leather sofa SC in terms of N, K, and influence matrix. In particular, the influence matrix shown in Figure 5 was obtained by translating each link between activities ai and aj of the leather sofa production process (Figure 4) into an x in the (i, j) and (j, i) cells of the matrix. As previously discussed, modeling the dynamics of the SC requires the assessment of its specific form of governance. The examined SC, in which Natuzzi plays the leading role, is characterized by high centralization of control and asymmetric distribution of the bargaining power. Therefore, the simulation model for the no-trust scenario was set by following steps 1.b.i, 2, 3.b.i, and 4 illustrated in Figure 2.

Figure 4: Map of the leather sofa production process

Figure 5: Influence matrix for the leather sofa supply chain

1000 different landscapes were generated based on the influence matrix shown in Figure 5. To ensure the statistical significance to our results, we run our simulation on each of the 1000 landscapes, and then averaged performance outcomes over the 1000 landscapes. Performance outcomes were computed for both the overall SC and its leading firm. Simulation times (i.e. the number of times the searching process is repeated) were set to 200.

Table 1 shows simulation results for both the trust and no-trust scenarios. For each scenario, the average and standard deviation of performance outcomes for both the SC and its leading firm, averaged over the 1000 landscapes, are reported. Differences in results are statistically significant (we performed a t-test, which is significant at p<10-6). In order to quantify the benefits of trust, we calculated the difference between the averaged performance outcomes obtained under the two examined scenarios. Results show that SC trust is beneficial for both the leading firm and the SC as a whole. This is not surprising, given that the positive influence of trust on performance in SC contexts has been largely emphasized in previous literature. However, a major contribution of our study lies in quantifying the performance benefits of SC trust, which allows us to overcome a limit of the extant literature on SC and trust, and provide potentially useful insights for managers. We also note that the performance benefits of trust in the examined SC are slightly higher for the leading firm than for the SC as a whole. A reasonable explanation for this is that, having more power than the other SC firms, the leading firm is able to appropriate a larger part of the SC performance improvement associated with trust.

| Trust scenario | No-trust scenario | Difference (%) | |

|---|---|---|---|

| Supply Chain | |||

| Average | 0.9425 | 0.9247 | + 1.78% |

| Std. deviation | 0.0524 | 0.0597 | |

| Leading firm | |||

| Average | 0.8576 | 0.8370 | + 2.06% |

| Std. deviation | 0.0974 | 0.1024 | |

Table 1: Simulation results. *Differences in results are significant at p<10-6

Conclusion

While extant studies on trust in SC contexts have typically focused on dyadic buyer-supplier relationships and neglected the issue of quantifying the benefits of trust, we have advanced a computational methodology derived from complexity science, and specifically based on NK simulation, to quantify the impact of SC trust on SC performance. Our study offers the following contributions to the SC literature. First, instead of looking at trust at the dyad level, we have focused on trust at the level of the overall SC, thus addressing an issue already raised but rarely explored in previous literature.

Second, we have offered a methodology to quantify the performance benefits of SC trust, which can be useful for SC managers to make decisions about whether to invest or not in the development of trust across the SC. Specifically, we have initially explained how to build the NK model of a generic SC by showing how to set the model parameters, i.e., the number of SC activities (N), the average number of interactions among the activities (K), and the influence matrix mapping the interactions among the activities. Next, we have illustrated how to obtain the fitness landscape. Then, we have focused on how to model the dynamics of the SC in two different scenarios (i.e., the trust and no-trust scenarios), framing such dynamics as an adaptive walk of the SC on the fitness landscape. In particular, since previous literature has argued that the form of governance of the SC affects SC evolution, we have explained how to model the dynamics of the SC under different forms of governance. Finally, in order to clarify our proposed methodology and illustrate its use, we have applied it to a real-world SC.

The present study is not without its limitations. First, while we have attempted to overcome the limitations of previous research concerning the quantification of the benefits of trust, our proposed methodology allows us to take into account only two extreme scenarios, corresponding to the existence or non-existence of trust across the SC. However, trust may pervade SCs at different degrees. Therefore, future research will have to focus on trust as a continuous, rather than dichotomous, variable, and try to quantify the performance benefits associated with different degrees of trust. Moreover, in order to allow managers to assess more thoroughly whether to invest or not in the development of trust across the SC, we recommend that future research also concentrates on the costs associated with trust development.

References

Aggarwal, V., Siggelkow, N., and Singh H., (2011). "Governing collaborative activity: Interdependence and the impact of coordination and exploration," Strategic Management Journal, ISSN 1097-0266, 32: 705-730.

Albino, V., Carbonara, N., and Giannoccaro, I. (2009). "Supply chain management models for industrial districts: An agent-based simulation study," International Journal of Intelligent Systems Technologies and Application, ISSN 1740-8873, 6(3/4): 332-348.

Bozarth, C., Warsing, D., Flynn, B., and Flynn, J. (2009). "The impact of supply chain complexity on manufacturing plant performance," Journal of Operations Management, ISSN 0272-6963, 27(1): 79-93.

Bradach, J.L. and Eccles, R.G. (1989). "Price, authority, and trust. From ideal types to plural forms," Annual Review of Sociology, ISSN 1545-2115, 15: 97-118.

Capaldo, A. (2007). "Network structure and innovation: The leveraging of a dual network as a distinctive relational capability," Strategic Management Journal, ISSN 1097-0266, 28: 585-608.

Capaldo, A. (2014). "Network governance: A cross-level study of social mechanisms, knowledge benefits, and strategic outcomes in joint-design alliances," Industrial Marketing Management, ISSN 0019-8501, 43(4): 685-703.

Capaldo, A. and Giannoccaro, I. (2015). "How does trust affect performance in the supply chain? The moderating role of interdependence," International Journal of Production Economics, ISSN 0925-5273, 166(8): 36-49, ISSN: 0925-5273.

Capaldo, A. and Giannoccaro, I. (2015). "Interdependence and network-level trust in supply chain networks: A computational study," Industrial Marketing Management, ISSN 0019-8501, 44(1): 180-195.

Carbonara, N., Giannoccaro, I., and Pontrandolfo, P. (2002). "Supply chains within industrial districts: A theoretical framework," International Journal of Production Economics, ISSN 0925-5273, 76: 159-176.

Choi, T.Y. and Krause, D.R. (2006). "The supply base and its complexity: Implications for transaction costs, risks, responsiveness, and innovation," Journal of Operations Management, ISSN 0272-6963, 24: 637-652.

Choi, T.Y., and Hong, Y. (2002). "Unveiling the structure of supply networks: Case studies in Honda, Acura, and DaimlerChrysler," Journal of Operations Management, ISSN 0272-6963, 20: 469-493.

Choi, T.Y., Dooley, K., and Rungtusanatham, M. (2001). "Supply networks and complex adaptive systems: Control versus emergence," Journal of Operations Management, ISSN 0272-6963, 19: 351 366.

Christopher, M. (1992). Logistics and Supply Chain Management, ISBN 9780273681762.

Cooper, M.C. and Ellram, L. (1993). "Characteristics of supply chain management and implications for purchasing and logistics," International Journal of Logistics Management, ISSN 0957-4093, 4(2): 13-22.

Dirks, K.T. and Ferrin, D.L. (2001). "The role of trust in organizational settings," Organization Science, ISSN 1526-5455, 12: 450-467.

Dooley, K.J. (1997). "A complex adaptive systems model of organization change," Nonlinear Dynamics, Psychology, and Life Sciences, ISSN 1090-0578, 1(1): 69-97.

Dyer J.H. and Chu, W. (2003). "The role of trustworthiness in reducing transaction costs and improving performance: Empirical evidence from the United States, Japan, and Korea," Organization Science, ISSN 1047-7039, 14: 57-68.

Gambetta, D. (1988). "Can we trust trust?," in D. Gambetta, Trust: Making and Breaking Co-operative Relations, ISBN 9780631175872, pp. 213-237.

Ganco, M. and Hoetker, G. (2009). "NK modeling methodology in the strategy literature: Bounded search on a rugged landscape," in D.D. Bergh and D.J. Ketchen (eds.), Research Methodology in Strategy and Management, ISBN 9781848551589, pp. 237-268.

Gavetti, G. and Levinthal, D. (2000). "Looking forward and looking backward: Cognitive and experiential search," Administrative Science Quarterly, ISSN 0001-8392, 45: 113-137.

Giannoccaro, I. (2011). "Assessing the influence of the organization in the supply chain management using NK simulation," International Journal of Production Economics, ISSN 0925-5273, 131: 263-272.

Giannoccaro, I. (2015). "Adaptive supply chains in industrial districts: A complexity science approach focused on learning," International Journal of Production Economics, ISSN 0925-5273, 170(B): 576-589.

Goldstein, J. (1999). "Emergence as a construct: History and issues," Emergence, ISSN 1521-3250, 1: 49-72.

Handfield, R.B. and Bechtel, C. (2002). "The role of trust and relationship structure in improving supply chain responsiveness," Industrial Marketing Management, ISSN 0019-8501, 31: 367-382.

Heide, J.B. and Miner, A.S. (1992). "The shadow of the future: Effects of anticipated interaction and frequency of contact on buyer-seller cooperation," Academy of Management Journal, ISSN 0001-4273, 35(2): 265-291.

Holland, J.H. (1995). Hidden Order: How Adaptation Builds Complexity, ISBN 9780201442304.

Holland, J.H. (2002). "Complex adaptive systems and spontaneous emergence," in A. Quadrio Curzio and M. Fortis (eds.), Complexity and Industrial Clusters, ISBN 9783790814712.

Ireland R.D. and Webb J.W. (2007). "A multi-theoretic perspective on trust and power in strategic supply chains," Journal of Operations Management, ISSN 0272-6963, 25: 482-497.

Johnston, D.A., McCutcheon, D.M., Stuart, F.I., and Kerwood, H. (2004). "Effects of supplier trust on performance of cooperative supplier relationships," Journal of Operations Management, ISSN 0272-6963, 22: 23-38.

Kauffman, S. (1993). The Origins of Order: Self-Organization and Selection in Evolution, ISBN 9780195079517.

Krishnan, R., Martin, X., and Noorderhaven, N.G. (2006). "When does trust matter to alliance performance?" Academy of Management Journal, ISSN 0001-4273, 49(5): 894-917.

Kumar, N. (1996). "The power of trust in manufacturer-retailer relationships," Harvard Business Review, ISSN 0017-8012, 6: 92-106.

Laaksonen T., Jarimo T., and Kulmala H. (2009). "Cooperative strategies in customer-supplier relationships: The role of inter-firm trust," International Journal of Production Economics, ISSN 0925-5273, 120: 79-87.

Lamming, R. (1996). "Squaring lean supply with supply chain management," International Journal of Operations and Production Management, ISSN 0144-3577, 16: 183-196.

Larson, A. (1992). "Network dyads in entrepreneurial settings: A study of the governance of exchange relationships," Administrative Science Quarterly, ISSN 0001-8392, 37(1): 76-104.

Lee, H.L., Padmanabhan, V., and Whang, S. (1997). "The bullwhip effect in the supply chains," Sloan Management Review, ISSN 1532-9194, 38(3): 93-102.

Mayer R.C., Davis J.H., and Schoorman, F.D. (1995). "An integrative model or organizational trust," Academy of Management Review, ISSN 0363-7425, 20: 709-734.

McEvily, B., Perrone, V., and Zaheer, A. (2003). "Trust as an organizing principle," Organization Science, ISSN 1526-5455, 14: 91-103.

McKelvey, B. (1999). "Avoiding complexity catastrophe in coevolutionary pockets: Strategies for rugged landscapes," Organization Science, ISSN 1526-5455, 10: 294-321.

Mentzer, J.T., DeWitt, W., Keebler, J.S., Min, S., Nix, N.W., Smith, C.D., and Zacharia, Z.G. (2001). "What is supply chain management," in J.T. Mentzer (ed.), Supply Chain Management, ISBN 9780761921110.

Monczka, R.M., Petersen, K.J., Handfield, R.B., and Ragatz, G.L. (1998). "Success factors in strategic supplier alliances: The buying company perspective," Decision Science, ISSN 0011-7315, 29: 553 577.

Narasimhan, R. and Nair, A. (2005). "The antecedent role of quality, information sharing and supply chain proximity on strategic alliance formation and performance," International Journal of Production Economics, ISSN 0925-5273, 96: 301-313.

Olson, D.L. and Swenseth, S.R. (2014). "Trade-offs in supply chain system risk mitigation," Systems Research and Behavioral Science, ISSN 1092-7026, 31: 565-579.

Pathak, S.D., Day, J.M., Nair, A., Sawaya, W.J., and Kristal, M.M. (2007). "Complexity and adaptivity in supply networks: Building supply network theory using a complex adaptive systems perspective," Decision Sciences, ISSN 1540-5915, 38: 547-580.

Rivkin, J.W. and Siggelkow, N. (2003). "Balancing search and stability: Interdependencies among elements of organizational design," Management Science, ISSN 1526-5501, 49: 290-311.

Rivkin, J.W. and Siggelkow, N. (2007). "Patterned interactions in complex systems: Implication for exploration," Management Science, ISSN 1526-5501, 43: 1068-1085.

Rousseau, D.M., Sitkin, S.B., Burt, R.S., and Camerer, C. (1998). "Not so different after all: A cross-discipline view of trust," Academy of Management Review, ISSN 0363-7425, 23: 393-404.

Seppanen, R., Blomqvist, K., and Sundqvist S. (2007). "Measuring inter-organizational trust: A critical review of the empirical research in 1990-2003," Industrial Marketing Management, ISSN 0019-8501, 36: 249-265.

Simchi-Levi, D., Kaminsky, P., and Simchi-Levi, E. (2000). Designing and Managing the Supply Chain: Concepts, Strategies and Case Studies, ISBN 978-0073341521 (2007).

Stock, G.N., Greis, N.P., and Kasarda, J.D. (2000). "Enterprise logistics and supply chain structure: The role of fit," Journal of Operations Management, ISSN 0272-6963, 18: 531-547.

Surana, A., Kumara, S., Greaves, M., and Raghavan, U.N. (2005). "Supply-chain networks: A complex adaptive systems perspective," International Journal of Production Research, ISSN 0020-7543, 20: 4235-4265.

Uzzi, B. (1997). "Social structure and competition in interfirm networks: The paradox of embeddedness," Administrative Science Quarterly, ISSN 0001-8392, 42: 35-67.

Wicks, A.C., Berman, S.L., and Jones, T.M. (1999). "The structure of optimal trust: Moral and strategic implications," Academy of Management Review, ISSN 0363-7425, 24: 99-116.

Zucker, L.G. (1986). "Production of trust: Institutional sources of economic structure 1840-1920," in B.M. Staw and L.L. Cummings (eds.), Research in Organizational Behavior, ISBN 9780892325511, pp. 53-111.